Commodities Week Ahead: OPEC Sees Oil Rally Amit You. riots; Gold Seas $ 1780

If OPEC has its way, a May rally in oil may take shape in June.

But before that, American protesters could have their way.

A week of mass demonstrations across the United States after the murder of a black man George Floyd in police custody in Minneapolis has confused mayors and governors, who are trying to reopen American states and cities altogether , Has been discontinued in the last three months by the coronovirus epidemic.

US protests downside to oil

Forexime analyst Han Tan wrote, "The outbreak of violence has added another layer of uncertainty to global investors, who are already at risk of escalating US-China tensions."

The Organization of Petroleum Exporting Countries, aided by Russia, is aiming to bring both crude benchmarks above $ 40 to increase the pace of last month's rally. He plans to pursue a meeting of the OPEC + expansion of an expanded oil-exporting branch - including Russia - from its original June 10 event as an affiliate this Friday.

A Reuters poll on Friday indicated that OPEC and its partners have made good on a decline of about 6 million barrels per day by May - about three-quarters of 9.7 million barrels per day by the end of the year.

But will things continue sailing as OPEC + and Americans - who are still not part of the cartel in any way - think? Julian Lee, Bloomberg's oil columnist, is not afraid.

"For now, the results of the collaboration are almost right to be very good," Lee wrote, an initiative to cover up oil.

Saw the red flag though

Moving forward, he sees red flags as something in OPEC +, most notably Russia, eager to stick to their letter of deal from April, where they are starting to reopen their oil taps from July Huh.

But if it does, it could trigger a rapid withdrawal of anywhere between 2 million and about 4 million barrels per day supply, he warns.

Adds Lee:

As I argued in my weekly review of oil on Sunday, a May rally in crude oil cut the oil leak well and was shut down and American drillers fueled with COVID-19 Had responded to a drop in demand, which removed RTI at one point minus $ 37 a barrel.

No time to turn on the tap yet

However, the latest figures show that US producers, fascinated by high prices, have begun cutting output, triggering last month's price yields. This can be a problem for the nascent recovery seen so far in the market, especially if demand does not catch up as fast as possible.

The last 2- in the latest weekly survey of oil drilling patches by industry firm Baker Hughes. Many times during the months, only more than 15 oil leakage reductions have been observed per week.

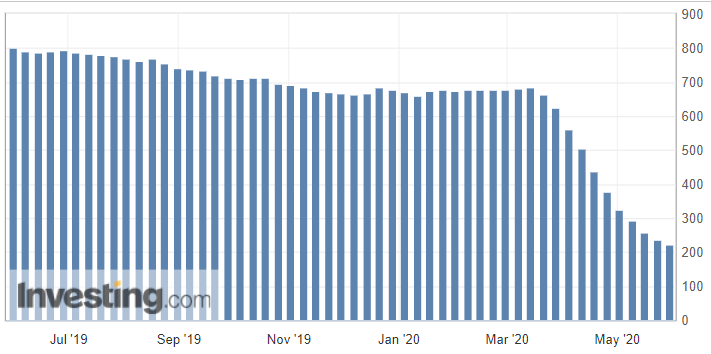

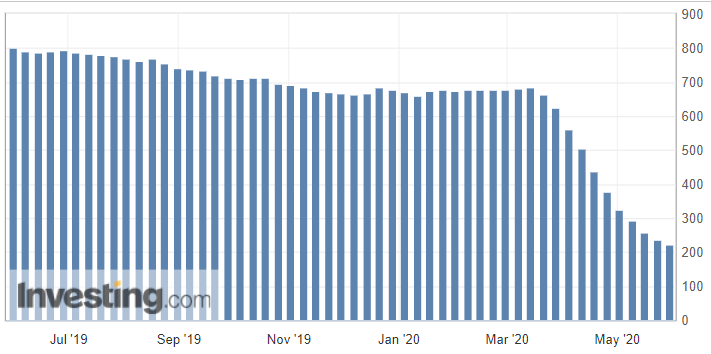

To be sure, the US oil rig count is down 68% since the week ending March 13, with crude oil production estimated at 11.4 million barrels per day from a record high of 13.1 million bpd three months earlier. But the pace of decline has slowed in recent weeks, indicating that drillers were holding back on cuts as the surge in crude oil prices lured them to take out more barrels in exchange for more cash.

Gasoline reserves, meanwhile, fell by a relatively small 724,000 barrels during the same week, a forecast of 100,000.

Worse still, distillation inventories rose 5.5 million barrels to achieve approximately 42 million barrels over the last eight weeks.

Distillates, which include products such as diesel and jet fuel, have been the weakest components of the US oil complex since the COVID-19 outbreak. Despite reopening from the lockdown, some have called for diesel and jet fuel to take public transport or flights due to apprehensive fears about the infection.

But even though these drillers go above the belly, it does not mean that they will stop producing oil. This is due to the unique nature of US bankruptcy laws, which provide companies with protection from debtors while they continue to operate and restructure.

An example is the Tulsa, Oklahoma-based Entity Corporation (NYSE: UNT), which became the third US oil drill since the outbreak of COVID-19 to file for bankruptcy last week after being hit by debt of more than $ 650 million. Gone.

Unit Corporation said it expects its vendors, customers, or partners to continue operating regularly through the Chapter 11 bankruptcy process without material divestment. It also said it is expected to emerge from the process "with a $ 180 million exit financing facility."

This means that we can stabilize US production even with more oil bankruptcies. A strange world indeed.

If OPEC has its way, a May rally in oil may take shape in June.

But before that, American protesters could have their way.

A week of mass demonstrations across the United States after the murder of a black man George Floyd in police custody in Minneapolis has confused mayors and governors, who are trying to reopen American states and cities altogether , Has been discontinued in the last three months by the coronovirus epidemic.

US protests downside to oil

Forexime analyst Han Tan wrote, "The outbreak of violence has added another layer of uncertainty to global investors, who are already at risk of escalating US-China tensions."

The Organization of Petroleum Exporting Countries, aided by Russia, is aiming to bring both crude benchmarks above $ 40 to increase the pace of last month's rally. He plans to pursue a meeting of the OPEC + expansion of an expanded oil-exporting branch - including Russia - from its original June 10 event as an affiliate this Friday.

New OPEC hope after final disaster

The last time OPEC + was found, it was a disaster. Then the Saudis, who controlled the cartel, wanted deep production cuts. The Russians did not. The resulting price war - in the midst of a gust of American shale oil - played out in a perfect storm of demand destruction from COVID-19, which was ultimately not seen in market history: the price for sub-zero WTI. But with all that declared as water under the bridge, the Saudis, Russians and, quite unbelievably, are working together to try and deliver the best return for American-Crood.A Reuters poll on Friday indicated that OPEC and its partners have made good on a decline of about 6 million barrels per day by May - about three-quarters of 9.7 million barrels per day by the end of the year.

But will things continue sailing as OPEC + and Americans - who are still not part of the cartel in any way - think? Julian Lee, Bloomberg's oil columnist, is not afraid.

"For now, the results of the collaboration are almost right to be very good," Lee wrote, an initiative to cover up oil.

Saw the red flag though

Moving forward, he sees red flags as something in OPEC +, most notably Russia, eager to stick to their letter of deal from April, where they are starting to reopen their oil taps from July Huh.

But if it does, it could trigger a rapid withdrawal of anywhere between 2 million and about 4 million barrels per day supply, he warns.

Adds Lee:

As I argued in my weekly review of oil on Sunday, a May rally in crude oil cut the oil leak well and was shut down and American drillers fueled with COVID-19 Had responded to a drop in demand, which removed RTI at one point minus $ 37 a barrel.

No time to turn on the tap yet

However, the latest figures show that US producers, fascinated by high prices, have begun cutting output, triggering last month's price yields. This can be a problem for the nascent recovery seen so far in the market, especially if demand does not catch up as fast as possible.

The last 2- in the latest weekly survey of oil drilling patches by industry firm Baker Hughes. Many times during the months, only more than 15 oil leakage reductions have been observed per week.

To be sure, the US oil rig count is down 68% since the week ending March 13, with crude oil production estimated at 11.4 million barrels per day from a record high of 13.1 million bpd three months earlier. But the pace of decline has slowed in recent weeks, indicating that drillers were holding back on cuts as the surge in crude oil prices lured them to take out more barrels in exchange for more cash.

US oil balance is still high

In addition, weekly balances on US crude oil tracked by the Energy Information Administration saw an increase of nearly 8 million barrels for the week ending May 22, the largest increase since the end of April.Gasoline reserves, meanwhile, fell by a relatively small 724,000 barrels during the same week, a forecast of 100,000.

Worse still, distillation inventories rose 5.5 million barrels to achieve approximately 42 million barrels over the last eight weeks.

Distillates, which include products such as diesel and jet fuel, have been the weakest components of the US oil complex since the COVID-19 outbreak. Despite reopening from the lockdown, some have called for diesel and jet fuel to take public transport or flights due to apprehensive fears about the infection.

US oil bankrupt; A false assurance of lost production

Eliminating lethargy in production cuts reflects the notion that many American oil drillers are still upset. Demand continues to devastate due to the epidemic and without high demand for crude oil, many drillers may go bankrupt.But even though these drillers go above the belly, it does not mean that they will stop producing oil. This is due to the unique nature of US bankruptcy laws, which provide companies with protection from debtors while they continue to operate and restructure.

An example is the Tulsa, Oklahoma-based Entity Corporation (NYSE: UNT), which became the third US oil drill since the outbreak of COVID-19 to file for bankruptcy last week after being hit by debt of more than $ 650 million. Gone.

Unit Corporation said it expects its vendors, customers, or partners to continue operating regularly through the Chapter 11 bankruptcy process without material divestment. It also said it is expected to emerge from the process "with a $ 180 million exit financing facility."

This means that we can stabilize US production even with more oil bankruptcies. A strange world indeed.

Comments

Post a Comment